Why Joining a Federal Lending Institution Is a Smart Selection

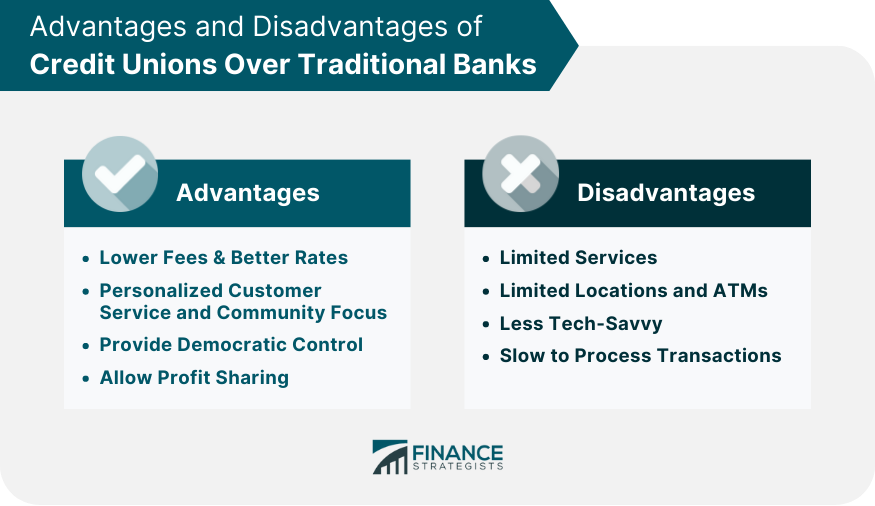

Signing Up With a Federal Lending institution represents a strategic economic relocation with countless advantages that satisfy individuals seeking an extra community-oriented and customized financial experience. The allure of reduced charges, competitive prices, and exceptional customer care collections lending institution apart in the financial landscape. Yet past these benefits exists a deeper dedication to member fulfillment and community sustain that establishes them apart. By exploring the special offerings of Federal Credit history Unions, individuals can use a globe of monetary empowerment and connection that surpasses traditional banking services.

Reduced Costs and Competitive Prices

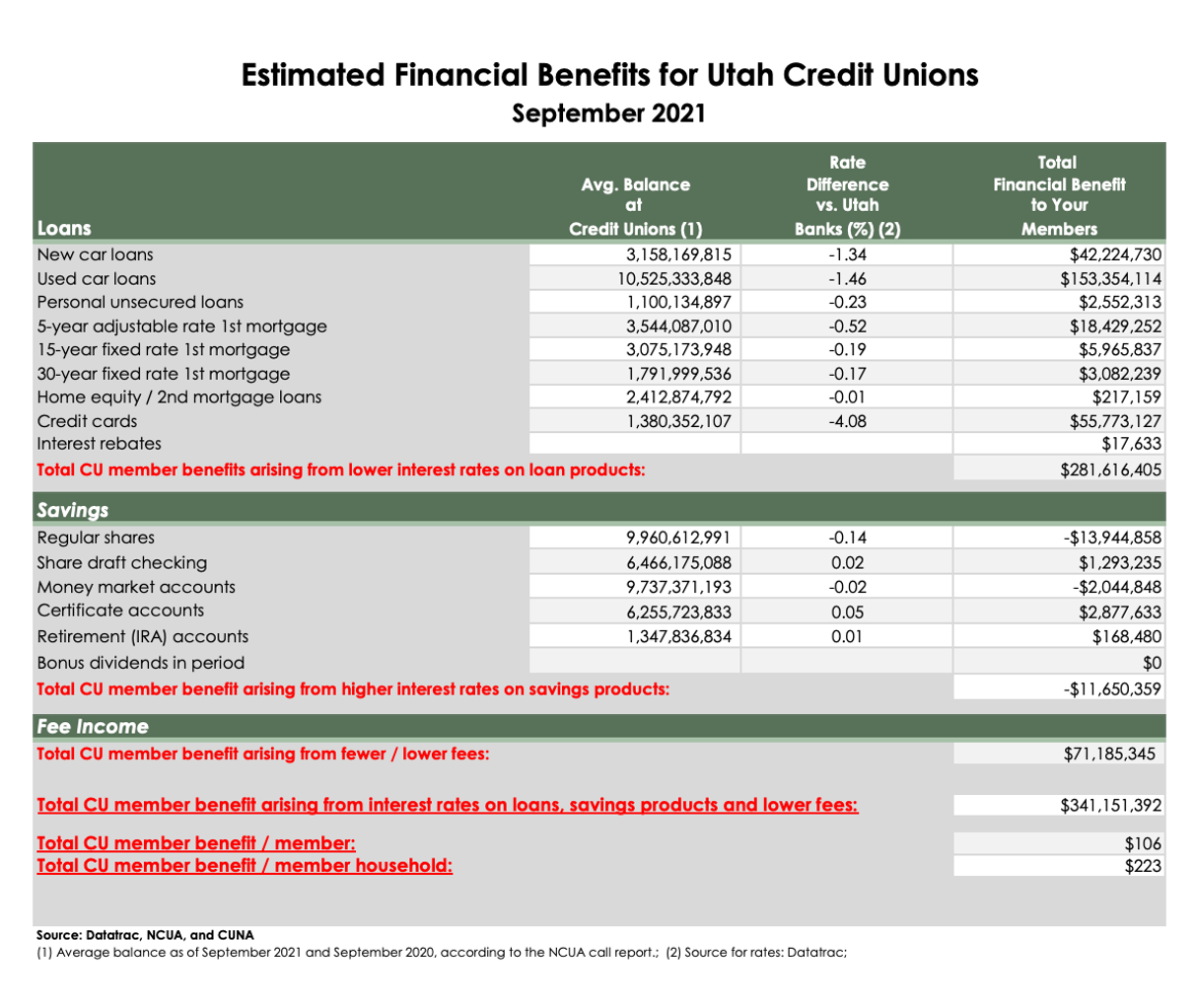

Furthermore, federal credit score unions usually supply more competitive rate of interest on interest-bearing accounts and financings compared to standard banks. By focusing on the financial wellness of their participants, credit score unions can supply higher passion prices on savings products, aiding individuals expand their money much faster. On the borrowing side, lending institution have a tendency to have lower rate of interest prices on lendings, consisting of mortgages, automobile finances, and personal finances, making it extra cost effective for members to accessibility credit history when required. Signing up with a federal lending institution can therefore cause substantial expense savings and monetary benefits for people seeking a more member-centric banking experience.

Emphasis on Participant Fulfillment

Federal cooperative credit union focus on member contentment by customizing their financial product or services to fulfill the special needs and choices of their participants. Unlike traditional financial institutions, government lending institution operate as not-for-profit companies, allowing them to concentrate on supplying exceptional solution to their members instead than making the most of profits. This member-centric technique is evident in the individualized interest members get when they connect with lending institution staff. Whether it's opening up a brand-new account, applying for a finance, or seeking monetary recommendations, participants can anticipate alert and encouraging service that aims to resolve their individual monetary goals.

By maintaining the finest passions of their members at heart, credit score unions produce a more positive and fulfilling financial experience. By picking to join a government credit report union, people can benefit from a monetary organization that really cares regarding their health and financial success.

Community-Oriented Method

Stressing area interaction and regional impact, federal cooperative credit union demonstrate a commitment to offering the requirements of their bordering neighborhoods. Unlike traditional financial institutions, government credit rating unions run as not-for-profit companies, allowing them to focus on benefiting their participants and neighborhoods instead of maximizing revenues. This community-oriented approach is noticeable in various facets of their operations.

Federal credit scores unions often prioritize supplying monetary solutions customized to the details requirements of the neighborhood neighborhood. By recognizing the distinct challenges and possibilities present in the neighborhoods they offer, these cooperative credit union can offer even more individualized and available economic solutions. This targeted approach promotes a feeling of belonging and trust among area participants, reinforcing the bond between the lending institution and its constituents.

Furthermore, government cooperative credit union often participate in community growth campaigns, such as supporting local businesses, funding occasions, and advertising monetary proficiency programs. These efforts not just add to the economic growth and security of the neighborhood yet additionally show the cooperative credit union's commitment to making a favorable effect past just economic solutions. By actively joining community-oriented tasks, federal credit score unions develop themselves as pillars of assistance and campaigning for within their areas.

Accessibility to Financial Education And Learning

With a concentrate on empowering participants with important economic knowledge and abilities, federal lending institution prioritize giving comprehensive and easily accessible economic education programs. These programs are designed to equip members with the devices they require to make informed decisions concerning their finances, such as budgeting, saving, spending, and credit history management. By using workshops, workshops, on-line sources, and one-on-one therapy, federal cooperative credit union ensure that their members have access to a large range of academic chances.

Monetary education and learning is crucial in assisting people browse the intricacies of individual money and achieve their long-lasting monetary goals. Federal lending institution understand the relevance of economic proficiency in advertising monetary wellness and stability among their members. By supplying these educational sources, they encourage people to take control a fantastic read of their economic futures and construct a strong structure for financial success.

Boosted Client Service

Members of government debt unions often experience a higher degree of customized solution, as these organizations prioritize personalized focus and support. Whether it's helping with account management, providing monetary suggestions, or dealing with worries quickly, federal credit score unions strive to exceed member assumptions.

One trick element of improved customer care in federal lending institution is the emphasis on building long-lasting relationships with participants. By putting in the time to comprehend members' economic goals and providing tailored options, cooperative credit union can provide meaningful assistance that surpasses transactional communications. In addition, government credit score unions normally have a strong community focus, further boosting the degree of client service by promoting a sense of belonging and Visit Your URL connection among participants.

Conclusion

Finally, joining a Federal Cooperative credit union uses many advantages such as lower charges, competitive rates, customized service, and access to economic education and learning (Credit Unions Cheyenne). With a concentrate on member satisfaction and community interaction, cooperative credit union focus on the financial well-being of their members. By selecting to be part of a Federal Credit scores Union, people can appreciate a customer-centric technique to financial that cultivates solid community links and equips them to make educated economic decisions

On the loaning side, credit score unions have a tendency to have lower rate of interest prices on fundings, including home mortgages, car financings, and individual finances, making it much more inexpensive for participants to access credit report when needed.Federal credit rating unions focus on member fulfillment by customizing their monetary items and services to fulfill the distinct demands and choices of their members.With an emphasis on empowering members with crucial financial knowledge and skills, government credit scores unions focus on providing extensive and obtainable financial education programs. Federal debt unions understand the importance of financial literacy in advertising economic health and security among their participants. With an emphasis on participant satisfaction and area interaction, debt unions focus on the financial well-being of check here their members.